Claim Mileage From Hmrc Form . Tax relief for employee business mileage. Hmrc mileage claim rules allow you to claim expenses connected with driving your personal vehicle for business purposes. What is mileage allowance relief (mar)? Claiming mileage tax relief from. You can make a claim if: Also known as mileage allowance relief. Your claim is within 4 years from the end of the tax year you are claiming for. Your total expenses claim for. If you are an employee use this form to tell us about employment expenses you have had to pay during the year for which tax relief is due. If you make payments to employees above a certain amount, you’ll have to report them to hm revenue and customs ( hmrc) and.

from printableformsfree.com

You can make a claim if: Claiming mileage tax relief from. If you make payments to employees above a certain amount, you’ll have to report them to hm revenue and customs ( hmrc) and. Tax relief for employee business mileage. Your claim is within 4 years from the end of the tax year you are claiming for. Your total expenses claim for. If you are an employee use this form to tell us about employment expenses you have had to pay during the year for which tax relief is due. What is mileage allowance relief (mar)? Also known as mileage allowance relief. Hmrc mileage claim rules allow you to claim expenses connected with driving your personal vehicle for business purposes.

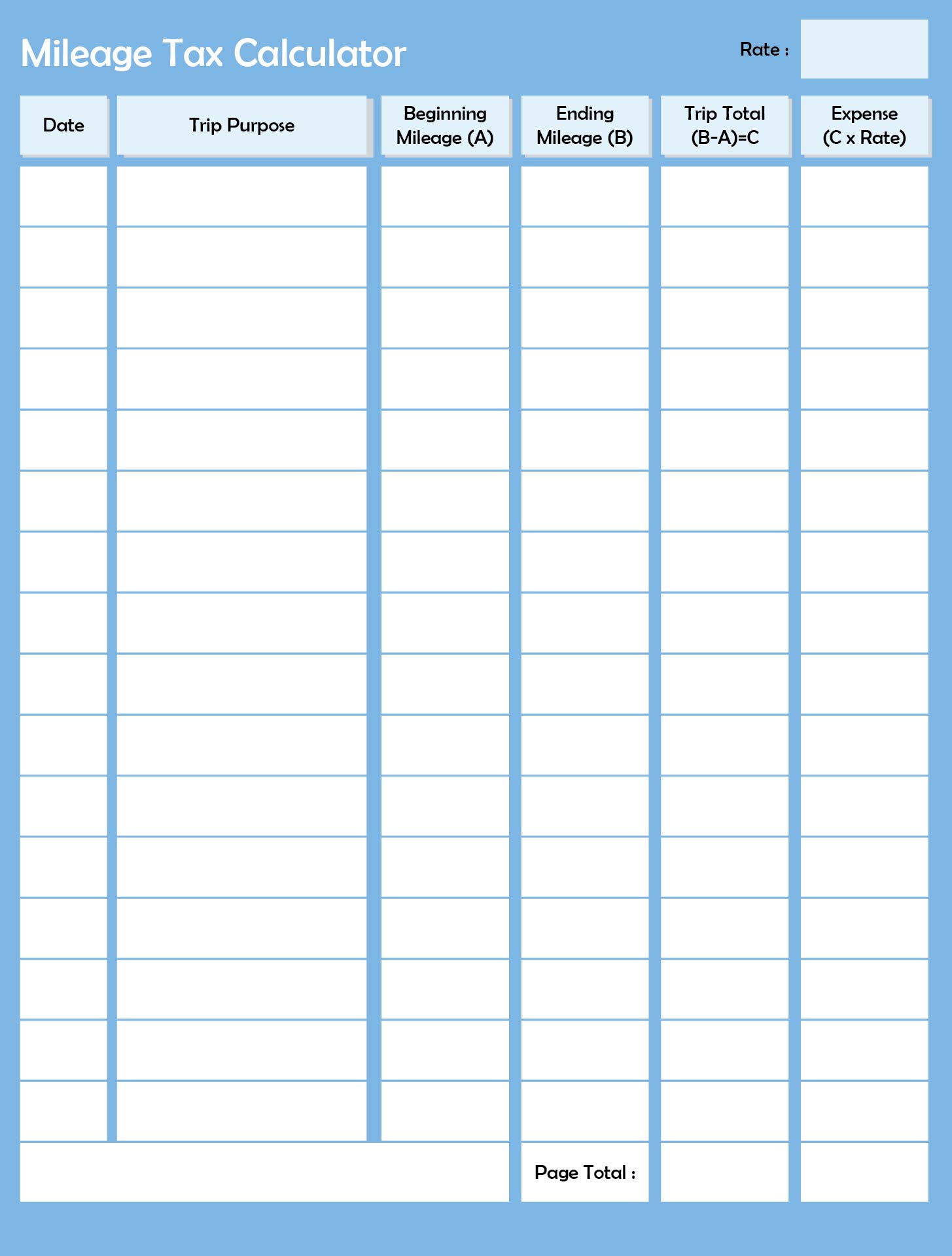

Free Printable Mileage Tracker Form Printable Forms Free Online

Claim Mileage From Hmrc Form Your claim is within 4 years from the end of the tax year you are claiming for. Also known as mileage allowance relief. If you are an employee use this form to tell us about employment expenses you have had to pay during the year for which tax relief is due. Tax relief for employee business mileage. You can make a claim if: Hmrc mileage claim rules allow you to claim expenses connected with driving your personal vehicle for business purposes. Your total expenses claim for. Claiming mileage tax relief from. What is mileage allowance relief (mar)? If you make payments to employees above a certain amount, you’ll have to report them to hm revenue and customs ( hmrc) and. Your claim is within 4 years from the end of the tax year you are claiming for.

From www.uslegalforms.com

UK HMRC VAT 411A 2008 Fill and Sign Printable Template Online US Claim Mileage From Hmrc Form If you are an employee use this form to tell us about employment expenses you have had to pay during the year for which tax relief is due. Claiming mileage tax relief from. What is mileage allowance relief (mar)? You can make a claim if: Your total expenses claim for. If you make payments to employees above a certain amount,. Claim Mileage From Hmrc Form.

From www.pinterest.com

Free UK Mileage Log Invoice template, Mileage, Templates Claim Mileage From Hmrc Form Your claim is within 4 years from the end of the tax year you are claiming for. Claiming mileage tax relief from. Hmrc mileage claim rules allow you to claim expenses connected with driving your personal vehicle for business purposes. If you are an employee use this form to tell us about employment expenses you have had to pay during. Claim Mileage From Hmrc Form.

From www.pdffiller.com

20192024 Form UK HMRC P356 Fill Online, Printable, Fillable, Blank Claim Mileage From Hmrc Form If you are an employee use this form to tell us about employment expenses you have had to pay during the year for which tax relief is due. Claiming mileage tax relief from. Your total expenses claim for. Hmrc mileage claim rules allow you to claim expenses connected with driving your personal vehicle for business purposes. Tax relief for employee. Claim Mileage From Hmrc Form.

From www.pdffiller.com

2011 Form UK HMRC P87 Fill Online, Printable, Fillable, Blank pdfFiller Claim Mileage From Hmrc Form Your claim is within 4 years from the end of the tax year you are claiming for. Hmrc mileage claim rules allow you to claim expenses connected with driving your personal vehicle for business purposes. Also known as mileage allowance relief. If you make payments to employees above a certain amount, you’ll have to report them to hm revenue and. Claim Mileage From Hmrc Form.

From www.zervant.com

Free UK Mileage Log Template Zervant Claim Mileage From Hmrc Form Also known as mileage allowance relief. You can make a claim if: Tax relief for employee business mileage. Your claim is within 4 years from the end of the tax year you are claiming for. Hmrc mileage claim rules allow you to claim expenses connected with driving your personal vehicle for business purposes. If you are an employee use this. Claim Mileage From Hmrc Form.

From www.sampletemplates.com

FREE 11+ Sample Mileage Reimbursement Forms in MS Word PDF Excel Claim Mileage From Hmrc Form If you make payments to employees above a certain amount, you’ll have to report them to hm revenue and customs ( hmrc) and. Tax relief for employee business mileage. Your claim is within 4 years from the end of the tax year you are claiming for. Your total expenses claim for. Hmrc mileage claim rules allow you to claim expenses. Claim Mileage From Hmrc Form.

From www.etsy.com

Printable Mileage Log Tracker, Mileage Tracker Printable, Business Claim Mileage From Hmrc Form Your total expenses claim for. You can make a claim if: Hmrc mileage claim rules allow you to claim expenses connected with driving your personal vehicle for business purposes. If you are an employee use this form to tell us about employment expenses you have had to pay during the year for which tax relief is due. Tax relief for. Claim Mileage From Hmrc Form.

From www.pdffiller.com

20222024 Form UK HMRC SA108 Fill Online, Printable, Fillable, Blank Claim Mileage From Hmrc Form Tax relief for employee business mileage. Hmrc mileage claim rules allow you to claim expenses connected with driving your personal vehicle for business purposes. Also known as mileage allowance relief. Your claim is within 4 years from the end of the tax year you are claiming for. If you are an employee use this form to tell us about employment. Claim Mileage From Hmrc Form.

From www.watermillaccounting.co.uk

Understanding the HMRC Mileage Claim Calculator Watermill Accounting Claim Mileage From Hmrc Form What is mileage allowance relief (mar)? Your total expenses claim for. Hmrc mileage claim rules allow you to claim expenses connected with driving your personal vehicle for business purposes. If you make payments to employees above a certain amount, you’ll have to report them to hm revenue and customs ( hmrc) and. Your claim is within 4 years from the. Claim Mileage From Hmrc Form.

From www.tmtaccounting.co.uk

Can I reclaim VAT on paying 45p mileage allowance? // TMT Accounting Claim Mileage From Hmrc Form Also known as mileage allowance relief. Your claim is within 4 years from the end of the tax year you are claiming for. Claiming mileage tax relief from. Hmrc mileage claim rules allow you to claim expenses connected with driving your personal vehicle for business purposes. What is mileage allowance relief (mar)? If you are an employee use this form. Claim Mileage From Hmrc Form.

From www.sampleforms.com

FREE 36+ Claim Form Samples, PDF, MS Word, Google Docs, Excel Claim Mileage From Hmrc Form Your total expenses claim for. Also known as mileage allowance relief. Your claim is within 4 years from the end of the tax year you are claiming for. If you are an employee use this form to tell us about employment expenses you have had to pay during the year for which tax relief is due. You can make a. Claim Mileage From Hmrc Form.

From www.sampleforms.com

FREE 36+ Claim Form Samples, PDF, MS Word, Google Docs, Excel Claim Mileage From Hmrc Form If you make payments to employees above a certain amount, you’ll have to report them to hm revenue and customs ( hmrc) and. If you are an employee use this form to tell us about employment expenses you have had to pay during the year for which tax relief is due. You can make a claim if: Claiming mileage tax. Claim Mileage From Hmrc Form.

From www.mnks.work

図書館でか買ってほしい本 20 図書(教育)〜M活 Microsoft Office活用サイト Claim Mileage From Hmrc Form Tax relief for employee business mileage. Claiming mileage tax relief from. You can make a claim if: Hmrc mileage claim rules allow you to claim expenses connected with driving your personal vehicle for business purposes. Your total expenses claim for. If you make payments to employees above a certain amount, you’ll have to report them to hm revenue and customs. Claim Mileage From Hmrc Form.

From janes-creative-nonsense.blogspot.com

Hmrc Private Mileage Claim Form Erin Anderson's Template Claim Mileage From Hmrc Form Your total expenses claim for. What is mileage allowance relief (mar)? Your claim is within 4 years from the end of the tax year you are claiming for. Also known as mileage allowance relief. If you make payments to employees above a certain amount, you’ll have to report them to hm revenue and customs ( hmrc) and. Hmrc mileage claim. Claim Mileage From Hmrc Form.

From www.sampletemplates.com

FREE 49+ Claim Forms in PDF Claim Mileage From Hmrc Form Also known as mileage allowance relief. Tax relief for employee business mileage. Your claim is within 4 years from the end of the tax year you are claiming for. Your total expenses claim for. If you are an employee use this form to tell us about employment expenses you have had to pay during the year for which tax relief. Claim Mileage From Hmrc Form.

From mileiq.com

Free Mileage Log Template for Taxes, Track Business Miles Claim Mileage From Hmrc Form If you make payments to employees above a certain amount, you’ll have to report them to hm revenue and customs ( hmrc) and. Tax relief for employee business mileage. Also known as mileage allowance relief. You can make a claim if: If you are an employee use this form to tell us about employment expenses you have had to pay. Claim Mileage From Hmrc Form.

From www.youtube.com

HMRC Mileage Claims Explained Information on HMRC mileage payments Claim Mileage From Hmrc Form If you are an employee use this form to tell us about employment expenses you have had to pay during the year for which tax relief is due. Your claim is within 4 years from the end of the tax year you are claiming for. Also known as mileage allowance relief. Tax relief for employee business mileage. Claiming mileage tax. Claim Mileage From Hmrc Form.

From www.uslegalforms.com

UK HMRC Form HM4 20102021 Fill and Sign Printable Template Online Claim Mileage From Hmrc Form Your total expenses claim for. If you make payments to employees above a certain amount, you’ll have to report them to hm revenue and customs ( hmrc) and. Your claim is within 4 years from the end of the tax year you are claiming for. You can make a claim if: Also known as mileage allowance relief. Hmrc mileage claim. Claim Mileage From Hmrc Form.